Rain tax, or a fee for reducing natural land retention. Who is obligated to pay it and how can it be avoided?

Parallel to traditional taxes, a new levy has emerged on the horizon – the rain tax. Although it has been present in everyday life since 2018, it still remains relatively unfamiliar to most taxpayers. This type of fee aims to regulate the management of rainwater and land retention to counteract problems associated with the drainage of atmospheric precipitation. Nevertheless, many people still lack awareness of its existence or do not fully understand its implications.

The rain tax is an innovative instrument designed to encourage property owners to adopt more thoughtful and environmentally friendly management of rainwater. In essence, it involves a fee for the loss of the natural ability of the land to retain rainwater, which results from surface development and directing precipitation into sewage systems. The aim is to prevent excessive burdens on sewage networks and local flooding.

Who has to pay the rain tax? The rain tax primarily affects property owners on whose property, due to development or other forms of land management, there is a loss of natural rainwater retention. In practice, this means that if on a given property with an area exceeding 3500 m2 more than 70% of biologically active surface area is excluded due to development or other obstacles, the owner of such property will be obliged to pay the rain tax.

How much is the rain tax? The amount of the rain tax depends on several factors, such as the size of the lost retention area, land management methods, and local regulations. Tax rates are determined by local authorities such as mayors and city presidents. The values of these rates can vary significantly depending on the region and the degree of retention loss on a particular property.

Currently, rain tax rates can range from 0.1 zł/m2 to 0.60 zł/m2 per year, provided that there are rainwater retention devices on the property. In the absence of such devices, the tax rate can even be as high as 1 zł/m2 per year.

Example tax in Poznań: The roof area is 688 m2, the plot area is 44 m2, entirely paved, with water drainage into the municipal sewage system. The fee is 240 zł/month.

Planned changes In 2022, plans for amendments emerged, which would broaden the circle of individuals paying the rain tax. It was proposed to reduce the requirements regarding the taxable property area from 3500 m2 to 600 m2 and the building area from 70% to 50%. There were also plans to introduce increases in rates for reducing retention, up to 1.5 zł/m2 per year. Unfortunately, these changes were not implemented due to the economic crisis and concerns related to the election year.

How to avoid or minimize the rain tax?

To avoid the need to pay the rain tax or reduce its amount, several actions can be taken:

Thoughtful land management: When planning construction or renovation of property, attention should be paid to maintaining adequate land retention. Preserving a larger green area can help avoid higher fees.

Investment in water retention: Purchasing a rainwater tank or building small retention devices can significantly help minimize fees.

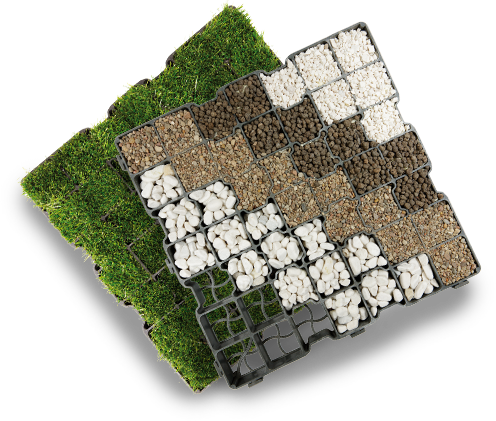

Replacing concrete surfaces: It is worth considering the use of more permeable materials, such as openwork eco-grids made from recycled material.

Cooperation with local authorities: Consult with local offices to learn about planned changes in regulations and possible opportunities to avoid or reduce the tax.

Expert support: Collaborating with specialists in rainwater retention can help in choosing optimal solutions and minimizing fees.

In conclusion, although the rain tax represents an additional burden for property owners, it can be avoided or minimized by taking appropriate actions and consciously managing the land. Understanding one’s tax obligations and taking proactive steps are important to avoid unnecessary costs associated with precipitation fees.